Transferring money is never an easy task, but with so many options available it can be overwhelming. This post will review the most popular methods of transferring money and help you decide which one to use.

Electronic Funds Transfer (EFT)

Electronic Funds Transfer is a simple, fast, and convenient way to send money from one person’s account to another.

The process of transferring funds electronically involves transmitting information about the sender and recipient through an automated clearinghouse (ACH) that links banks together into a nationwide payment system.

Information such as the date, time, amount transferred, and account number are transmitted electronically for the transaction to be completed.

Electronic transfers can be made from any bank or credit union account because it does not require a physical check or paper money transfer- just access to your personal banking information online!

There are some restrictions on electronic transactions depending on which type of account you use.

National EFT (NEFT)

NEFT is a fast and secure way of transferring money online. It stands for National Electronic Funds Transfer, and it was established in 2002 by the Reserve Bank of India.

NEFT is an Internet banking system that operates between banks in India, which makes it different from Western Union or PayPal because the sender doesn’t need to have an account with the recipient’s bank to make transactions happen.

The sender needs to provide their bank details as well as those of the recipient (the IFSC code) along with the amount they want to be transferred before submitting this information through their Internet banking portal or ATM.

This process can be done any time during working hours without having to wait for a business day, meaning that you could transfer money on your lunch break if you wanted.

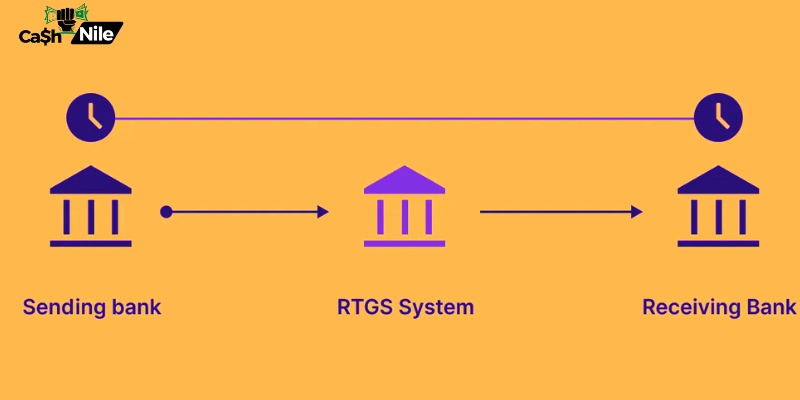

RTGS

The RTGS money transfer is a service that allows customers to send funds from one bank account to another in real-time.

It is one of the most common transactions in the world! The acronym stands for Real-Time Gross Settlement System.

This means there are no delays and the recipient will have access to their funds immediately when they receive them. It’s perfect for those who need urgent financial assistance and want to be sure it’s received as soon as possible!

It’s important because this is how money moves around when we make financial transactions on our credit cards, pay bills online, or send an international wire transfer. In other words, without RTGS you can’t go about your day-to-day life as you know it!

Immediate Payment Service (IMPS)

This a service offered by the Indian government which enables you to transfer money from one bank account to another in real time.

As different banks charge different transaction fees for this service, it is best that you do shop around with various banks as IMPS charges are standardized at 0.75% of the amount transferred under IMPS service, regardless of the amount being transferred or location of both India and receiver’s bank branches.

Wire Transfers

Wire transfers are a fast and secure way to send money. They are also called telegraphic transfers, bank drafts, or wire payments.

Wire transfer is the best option for those who need to make large international payments and want to avoid the high exchange rate fees associated with other methods of payment such as credit card purchases or PayPal transactions.

Wire Transfers can be done from one’s account at any bank in any country, and the transactions are facilitated by security codes provided by SWIFT and/or IBAN.

Checks (Cheques)

A cheque is a payment instrument that allows the payer to instruct their bank (the “drawee”) to pay money from their account to another person’s bank account.

It is drawn on a paying bank by order of its customer, which gives rise to it being sometimes referred to as an “order check”.

The word cheque comes from the medieval French checke meaning “to investigate” – customers would often include an extra sheet with additional information when sending their cheques for this reason.

eWallet Balance Transfers

eWallets refers to websites or apps that can be used to temporarily hold the money before being transferred to other users of the same eWallet, or before it is withdrawn to the user’s bank account.

There are many eWallets created for money transfers and online purchases and they include:

- Paypal

- Skrill

- Transferwise

- Remitly

- WorldRemit

Conclusion

You may be wondering what the best money transfer method is, and we’ve got you covered. Wire transfers are a great option if you want to send funds quickly from one bank account to another.

Checks can take up to 5 business days for delivery, but they also come with some protections that other types of payments don’t offer. EFTs are good for transferring large amounts or recurring payments because they’re easy and fast (you just have to know your recipient’s routing number).

Lastly, eWallets are an excellent way to pay on the go without having cash in hand – simply download their app! Which type(s) of money transfers do you use?